BACK TO ALL

BACK TO ALL

Blockchain is an emerging technology, and as such, it’s far from perfect. The invention of Bitcoin is more or less synonymous with the invention of blockchain, and Satoshi unveiled his new “digital cash” just ten years ago. If we were to compare blockchain to the internet, we’re somewhere in the nineteen-nineties in terms of development.

Given the newness of blockchain, it’s actually surprising how much has already been accomplished. Bitcoin is storing hundreds of billions of dollars’ worth of value, more than a million smart contracts have been launched on Ethereum, and dozens of banks have said that they plan to leverage XRP’s liquidity in order to make cross border payments more efficient. And those are just the top three projects.

What this article is not, however, is hype. It’s an honest look at what’s going right in blockchain and, just as importantly, what’s going wrong. For this is a new technology and as such, there is an untold number of problems that must be addressed. From bad code to immature infrastructure, which cannot accommodate the trillions of dollars of value flow that blockchain must handle in order to become adopted globally. With these blemishes in mind, let’s have an in-depth look at what’s holding blockchain back from mass adoption.

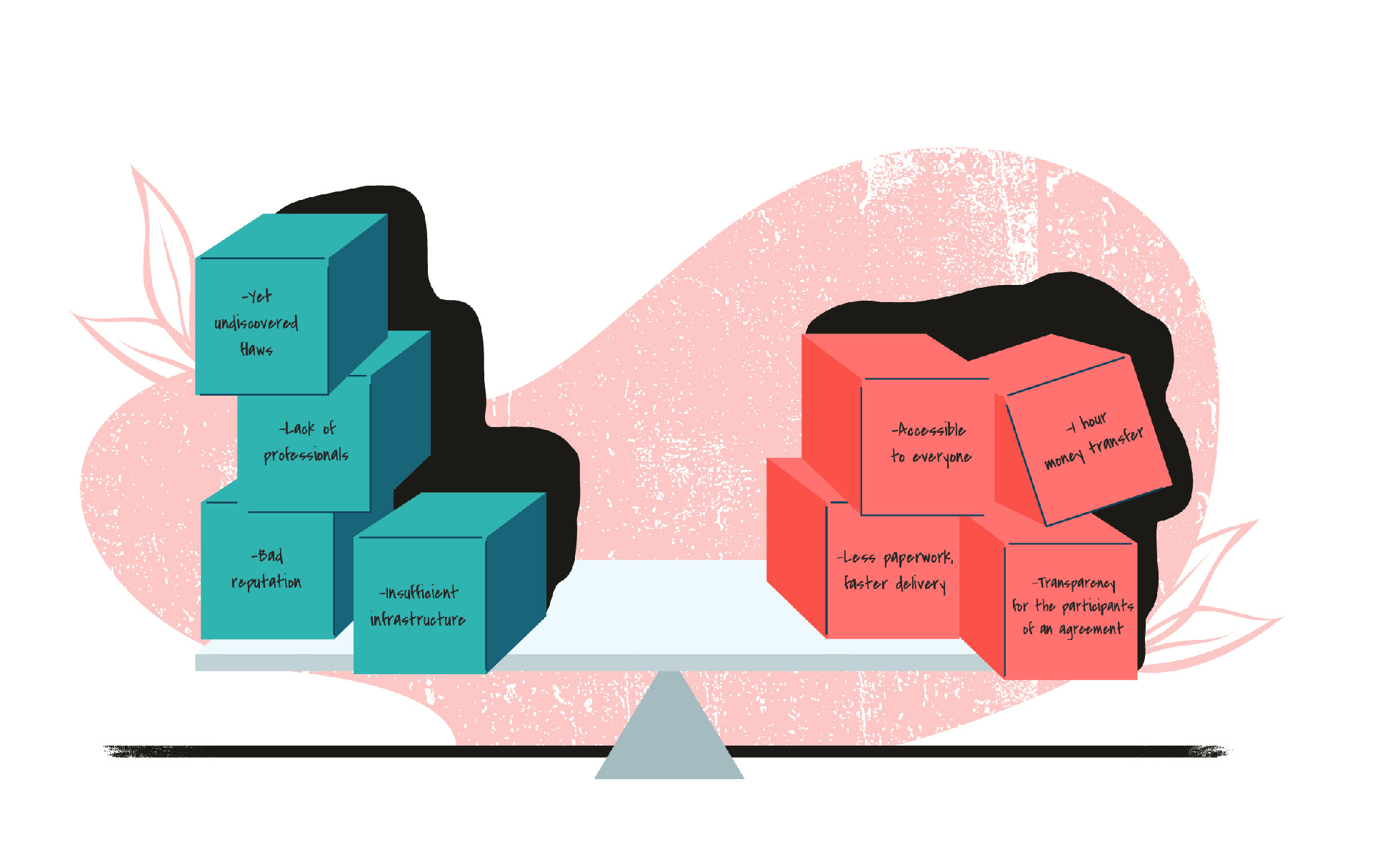

Drawbacks of Blockchain technology

Yet undiscovered flaws

Recently the NSA tipped off Microsoft to a “severe” vulnerability in the Windows 10 operating system. Had this vulnerability been exploited, hackers would have been able to install malware on computers and scoop up supposedly secure files at their leisure. It was an embarrassing day for the software company.

Now, Microsoft is a company with 150,000 employees. Their revenue in 2019 was in excess of $125 billion, which was enough to make them the 16th largest company in the world. Despite those employees and their billions in capital, Microsoft still managed to release software that was so severely compromised that the NSA had to play babysitter.

Compare that fiasco to blockchain where there are not 150,000 talented developers in the entire world, let alone working for one company. It’s all but guaranteed that there are crippling bugs lurking in the blockchain ecosystem, yet to be discovered. A blockchain project that’s considered safe today may be found to contain exploits tomorrow. There hasn’t been enough scrutiny, or frankly enough time, for this new technology to be fully understood. Whether a company is working with a public blockchain or implementing their own private chain, there is a non-zero chance that the protocol contains hidden flaws that have yet to be discovered. Thus early adopters stand to gain a competitive advantage over their non-blockchain rivals. However, there is always the risk that something goes wrong.

Lack of professionals

Speaking of developers, there is a shortage of talented blockchain developers. This shortage may rectify itself as the next generation, which grew up with Bitcoin, enters university. However, as it stands today, there are not enough developers to meet the demand. That means that even if a company wants to work with blockchain, they may have a difficult time getting the right people on their team. Some firms may choose to lose competitive advantage and wait till they can hire the right person. Other firms may hire the first person they can find and hope that they know what they’re doing.

Bad reputation

Many firms, however, are unlikely to do any hiring at all. While the situation is rapidly improving, blockchain still has an image problem. The problem is twofold. In the first place, Bitcoin (the project people most often think of when they hear the word blockchain) has been demonized for years as the tool of tax cheats and money launderers. Then came the ICO boom and bust, which revealed hundreds of projects with no real plan besides raising money. Scams everywhere, hype without substance. Many people who know little of blockchain will draw on one of these two narratives to explain the technology.

The disadvantage then is that bringing up blockchain can be contentious and, in some circumstances, may even color the speaker as an unreliable character. Thankfully as institutional interest increases and new legitimate use cases push out the old muck and mire, the narrative is evolving. Still, it might be years before the word blockchain evokes respectability and bleeding-edge innovation, not the tool of speculators and cash business crooks.

Blockchain is also unwieldy. It’s a sophisticated technology that combines computer science with cryptography, and thus there are a limited number of people who can implement it correctly. Mistakes are costly. The infamous DAO hack on Ethereum, for instance, would have led to the loss of $50,000,000 worth of funds had the Ethereum community not decided to amend the blockchain.

On a less significant level, it’s still difficult to write even the most mundane smart contracts. At this point, the UI is too complex for the average person to make much use of blockchain. It’s very similar to when computers ran on command line prompts. Only a dedicated handful of early enthusiasts took to the machines. It wasn’t until Apple popularized the graphic interface that computers really took off. The graphic interface equivalent for blockchain has yet to be invented, and so the technology remains firmly in the hands of early adopters and tinkerers.

Insufficient infrastructure

Finally, critical infrastructure is lacking. Smart contracts are not universally recognized as legally binding. Crypto firms have a great deal of trouble finding banks that will work with them. Until recently, it was difficult to custody funds, although Fidelity is diligently working to change this. Insurance is difficult, as well. If a company creates its own blockchain and wants to draw up an insurance plan that covers any losses, who can they find to take the other side of that deal? The Winklevoss twins, key players in the crypto industry, couldn’t find a good solution, and they ended up creating their own insurance company to solve the problem.

Whether it’s a public blockchain like Bitcoin or a private blockchain meant for internal use, there is still a dearth of knowledge and resources to help manage and run the chain. That will change, though. As adoption rises, as more people get involved in the community, as large companies see that there’s money to be made, the infrastructure will slowly fall into place. That’s the beginning of the good news, here’s the rest of it.

Benefits of Blockchain technology

Absolute accessibility

By and large, blockchain is an open source technology, and it’s readily accessible to anyone. A hobbyist in his bedroom or a Fortune 500 company can copy Ethereum’s source code and create their own network. This makes blockchain an exceptionally democratic technology. Blockchain also welcomes community participation. From the student submitting a few lines of code to GitHub, to EY which spent more than $1,000,000 developing the Nightfall private transaction protocol for Ethereum, there is a large community of volunteer developers working on all sorts of projects and their passion is advancing the technology every day.

Much faster money transfer

It’s no surprise that people want to work with this new technology as blockchain is demonstratively better than existing solutions. Even Bitcoin considered one of the slowest blockchain-based currencies, can move millions or billions of dollars in as little as an hour. That’s one hour from anywhere in the world to anywhere else. Traditionally when moving between low liquidity corridors, like South Africa to Ecuador, for instance, the transaction could take a week or more. Blockchain is a huge improvement, and providing cross border remittance is going to be one of blockchain’s killer applications. Blockchains can remit money exponentially quicker and more efficiently than traditional methods, whether that’s a public coin like XRP or a private one like JP Morgan’s JPM coin.

Transparency for the participants of an agreement

The immutable nature of blockchain is also fascinating. Blockchains are designed to store transaction data forever, meaning that for better or for worse, nothing is ever erased. Once it’s on the blockchain (a secure project at least), it’s there for good. This has widespread implications for everything from the shipping industry to digital copyright protection to property titles.

When someone buys a used car in the United States, they must fill out a form and sign the back of the old title, visit the DMV, pay a fee and then wait several weeks for the new title to arrive in the mail. If a title is stored on the blockchain, it could be transferred to a new owner in several seconds. Besides speed, there is the advantage of transparency.

Since transactions are immutable, it’s easy to see who the rightful owner is (especially once digital identities are stored on the blockchain), and theft becomes much more difficult. Instead of stealing a car with a piece of paper, a thief would need to steal the car and then forcefully get the owner to transfer the title to him via the blockchain. A much riskier undertaking. It’s unclear how long it will take to transition from paper to blockchain-based titles, however, few blockchain enthusiasts would be surprised to see all ownership documents existing exclusively on-chain sometime in the next ten years.

Less paperwork, faster delivery

Then there are smart contracts. An exciting new development, blockchain-enforced contracts are going to revolutionize business practices the world over. For instance, smart contracts are going to dramatically cut down on the time it takes for suppliers to get paid. With blockchain the payment for a shipment of goods can be escrowed in a smart contract beforehand then, once a shipment arrives and the digital bill of lading is signed for, the funds will automatically be sent to the manufacturer. Currently, it can take a month or more for a company to get paid for a product after they’ve delivered it. Blockchain will speed the process up tremendously.

Furthermore, smart contracts promise to reduce fraud. Given the immutable nature of blockchain, contracts cannot be deleted or surreptitiously altered. All changes are recorded, and so it becomes impossible to change a contract and claim that the new version is not different. Transparency is also a benefit in that anyone with the correct permission can view a smart contract from anywhere in the world. They’re much more accessible than paper documents or even documents stored in a traditional database.

Finally, smart contracts are going to save firms millions on middlemen costs. A smart contract doesn’t need to be guaranteed by a notary or signed by witnesses. It doesn’t need to be authenticated by a bank, and it requires fewer lawyers to interpret and enforce. When a contract is a piece of paper, there is a whole industry that exists to enforce it. When a contract is code, and the funds are already in escrow, the entire business cycle is much simpler.

The Future of Blockchain

With each year that blockchain survives, it becomes less likely that some foundational flaw is going to be exposed, some crippling bug that proves blockchain untenable. Undoubtedly many individual projects will falter on the rocks of bad code; however, the technology as a whole has been proving itself for the last decade, and it doesn’t appear that blockchain is going anywhere. An exciting time to be sure, for blockchain can do things that were previously impossible! From immutable record-keeping to the near-instantaneous transfer of wealth around the planet, blockchain is revolutionizing both the consumer and business world.

Of course, there are hiccups. Blockchain is a difficult technology to master, and there is an unfortunate shortage of talented programmers working with it. The result is buggy code and the all too common million-dollar exploits. Companies, investors, and speculators are right to be wary of investing too much in blockchain at this moment; there’s still a lot of work to be done. That work, however, will get done. The potential of blockchain has been proven beyond a doubt, and those who’ve recognized it are moving the entire industry forward. The following decade is going to be one of transformation, and the digital landscape of 2030 is going to look radically different than what we see today.

We help our clients to deliver high-quality distributed apps and web-apps with blockchain. If you have any questions about how blockchain might benefit your project, feel free to reach out, we offer a free consultation on the topic.